Review Stoke Pool

Review Stoke Pool: Premier Decentralized Pool For Proof Of Stokes On Blockchain Technology

ABOUT POOL OF STAKE

Pool of Stake (PSK) is a first of its kind, decentralized pool for Proof of Stake, the future of blockchain. Qtum, BOScoin, Tezos and other PoS coin holders can unite in the Pool of Stake and start Mining 2.0, generating daily forging rewards by simply staking their PoS coins.

Pool of Stake (PSK) is a unique self-regulated platform for Proof of Stake blockchains. PSK aims at increasing benefits for small investors who join the platform. With the help of Pool of Stake miners can generate forging rewards every day by merely putting their PoS coins on stake.

The platform will offer an analytics tool which will enable tracking, managing and optimizing user’s investments. PSK relies on an ERC-20 compatible PSK utility token and an IOU token which enable PSK users to get total control over their staked coins.

IDEA DEVELOPMENT

The idea of Pool of Stake is developing on current miners experiences and problems. Pool of Stake seems to be a solution. As you can see at the description below:

Current Situation

At the beginning all you needed to mine bitcoins was a computer and an application. Then the market has developed hardware making it much harder for the community to mine. It has, in turn, instigated the community to start forming mining pools. A mining pool allows its members to gain back the edge and start mining again.

New developement

Proof of Stake forging seems to be the future of mining.

Solution

A pool for Proof of Stake blockchains.

There are several benefits on taking part on a mining pool. First of all, the security of the system, the scale of economy, the saving of electricity, the AI in support of the best investment for PSK members- comparing the rewards of different blockchains based on real data of the members of the community and the support of the blockchains raising the voice via a transparent governance mechanism.

PROOF OF WORK & PROOF OF STAKE DIFERENCES

Proof-of-work: a method which requires miners to validate transactions on a blockchain by working out a mathematical function (called hash).

Proof-of-stake: a method which allows miners to validate block transactions according to how many coins they choose to put at stake on that network (as deposits). Here is a post where the founder of Ethereum explained a design philosophy of PoS.

Both methods exist to serve a common purpose on the blockchain: To validate that the person sending bitcoin (or any digital currency) has the correct amount of funds in their account. And that after the transaction is done, he or she no longer has the coin in their account (aka. to avoid double spending).

And yet, the two take an inherently different approach towards that goal. PoW v.s. PoS: Buying a shovel v.s. Deposit in a bank.

By definition, Proof-of-Work means to solve the hash function and prove the result is correct. While it’s hard to unravel the function, it’s easy for other miners to verify the result once a miner gets it – just putting it back to the function to see if it works out, like an algebraic problem. If it does, congrats! Here’s the prize. So take out your shovel, do the physical work, and show everybody you have mined the gold.

Proof-of-Stake, however, is a mechanism that needs no math. Instead, inside the network, you simply lock up a certain amount of your stake, i.e. your whatever cryptocurrency generated in this blockchain. That is your proof because something is at stake.

The network uses a random selection algorithm to determine who the next block creator is, with factors like how many coins you lock up, what the coin’s age is, or how long you have locked up already, etc. Different PoS-based blockchain has various criteria, but the gist is not much hardware work is required. It’s somewhat like deposition and interests.

In PoW-based blockchain, miners do the hard work and will be rewarded. Recall Bitcoin and Ethereum, where a new block rewards 12.5 Bitcoins and 5 Ethers. But there’s another thing called a transaction fee. When you send a Bitcoin to me, that transaction needs to be validated and documented on the blockchain through the hash function math that miners are doing.

But they are not doing it for free so you need to attach a transaction fee. The next lucky miner who creates the next block will receive all the transaction fees and the block reward itself, so it’s 12.5+ Bitcoins.

In PoS method, the blockchain has no block reward. Only transaction fees. That’s also why participants in the PoS blockchain should be called validators, not miners. They only facilitate the validation process of transactions without the mining activity like PoW does.</p>

POOL OF STAKE ICO DETAILS

Category : Cryptocurrency, Infrastructure, Mining, Platforms & Ecosystems

Country : Switzerland

ICO date : 2018-05-02 / 2018-06-03

Ends In : 44 days

Website : https://www.poolofstake.io/

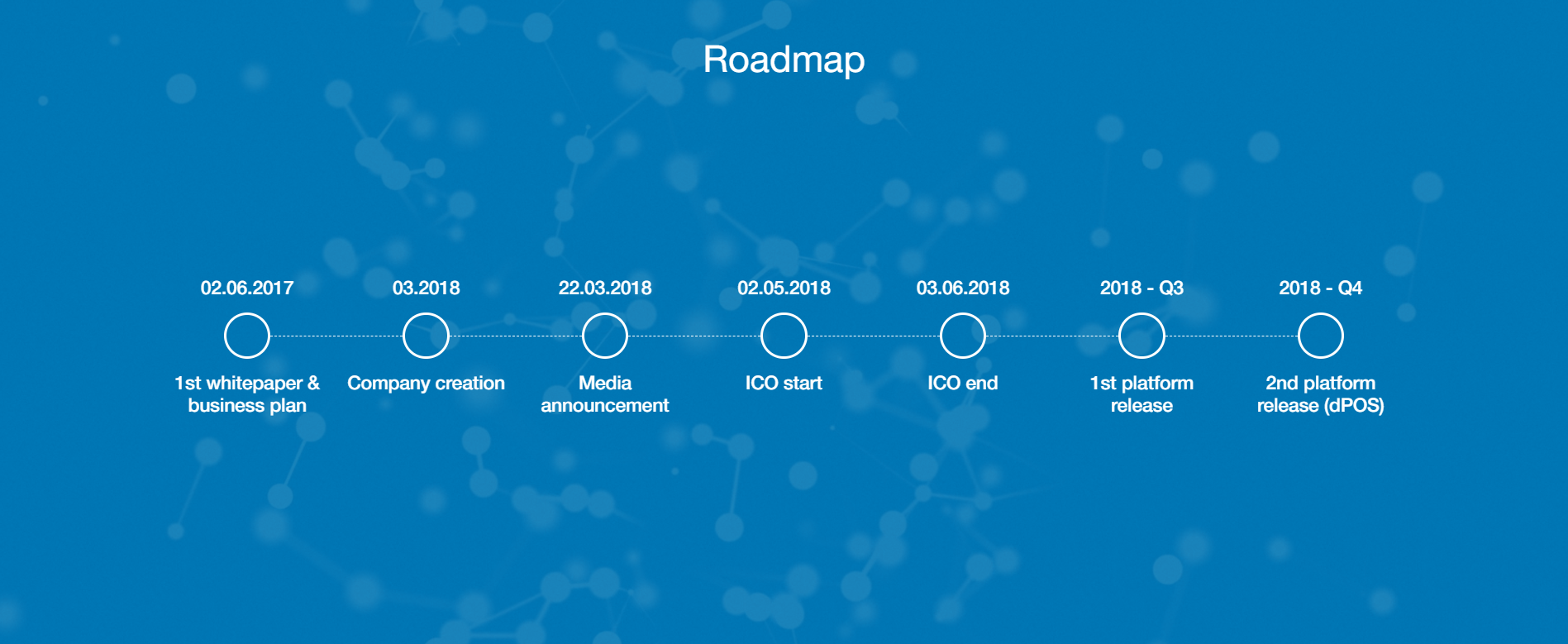

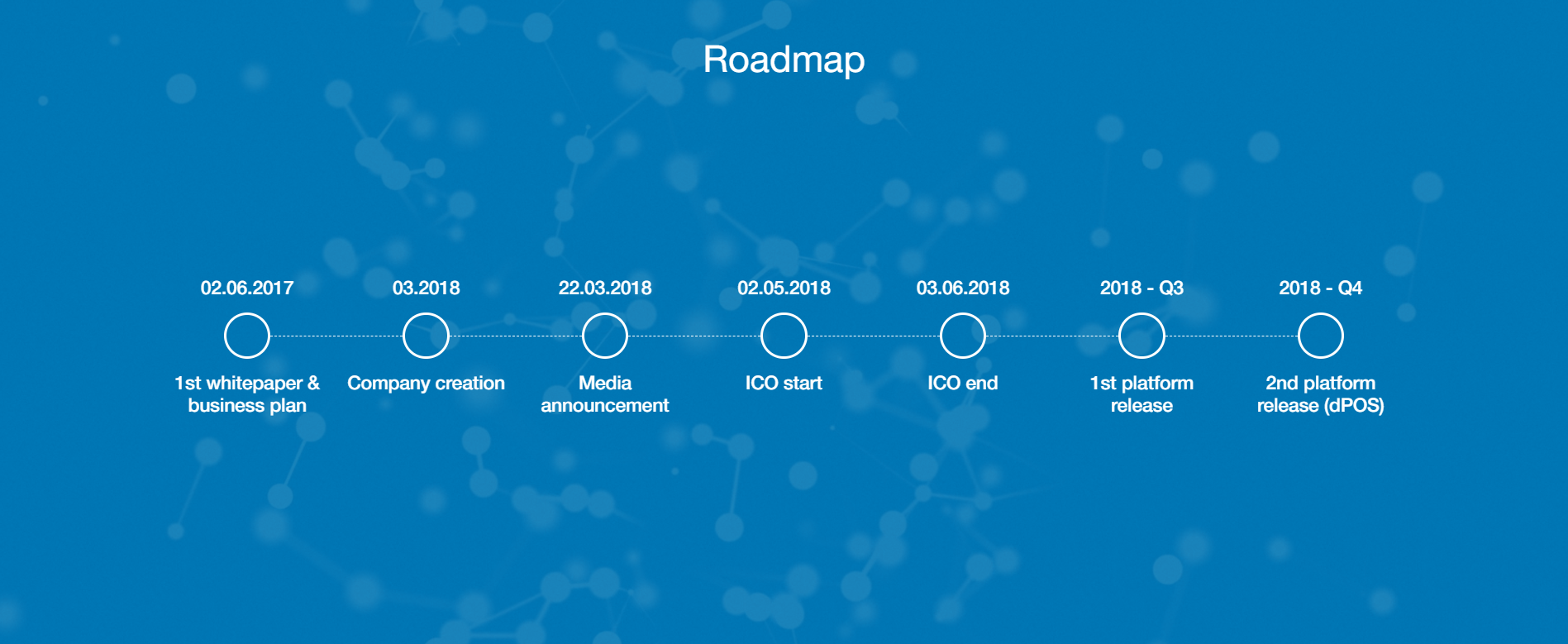

POOL OF STAKE ROADMAP

POOL OF STAKE TEAM

POOL OF STAKE RATING

WEBSITE : https://www.poolofstake.io/

ANN THREAD : https://bitcointalk.org/index.php?topic=3283742.0

TWITTER : https://twitter.com/poolofstake

WHITE PAPER : https://www.poolofstake.io/wp-content/uploads/2018/04/Pool_of_Stake_whitepaper.pdf

TELEGRAM : https://web.telegram.org/#/im?p=@poolofstake

FACEBOOK : https://www.facebook.com/poolofstake

ABOUT POOL OF STAKE

Pool of Stake (PSK) is a first of its kind, decentralized pool for Proof of Stake, the future of blockchain. Qtum, BOScoin, Tezos and other PoS coin holders can unite in the Pool of Stake and start Mining 2.0, generating daily forging rewards by simply staking their PoS coins.

Pool of Stake (PSK) is a unique self-regulated platform for Proof of Stake blockchains. PSK aims at increasing benefits for small investors who join the platform. With the help of Pool of Stake miners can generate forging rewards every day by merely putting their PoS coins on stake.

The platform will offer an analytics tool which will enable tracking, managing and optimizing user’s investments. PSK relies on an ERC-20 compatible PSK utility token and an IOU token which enable PSK users to get total control over their staked coins.

IDEA DEVELOPMENT

The idea of Pool of Stake is developing on current miners experiences and problems. Pool of Stake seems to be a solution. As you can see at the description below:

Current Situation

At the beginning all you needed to mine bitcoins was a computer and an application. Then the market has developed hardware making it much harder for the community to mine. It has, in turn, instigated the community to start forming mining pools. A mining pool allows its members to gain back the edge and start mining again.

New developement

Proof of Stake forging seems to be the future of mining.

Solution

A pool for Proof of Stake blockchains.

There are several benefits on taking part on a mining pool. First of all, the security of the system, the scale of economy, the saving of electricity, the AI in support of the best investment for PSK members- comparing the rewards of different blockchains based on real data of the members of the community and the support of the blockchains raising the voice via a transparent governance mechanism.

PROOF OF WORK & PROOF OF STAKE DIFERENCES

Proof-of-work: a method which requires miners to validate transactions on a blockchain by working out a mathematical function (called hash).

Proof-of-stake: a method which allows miners to validate block transactions according to how many coins they choose to put at stake on that network (as deposits). Here is a post where the founder of Ethereum explained a design philosophy of PoS.

Both methods exist to serve a common purpose on the blockchain: To validate that the person sending bitcoin (or any digital currency) has the correct amount of funds in their account. And that after the transaction is done, he or she no longer has the coin in their account (aka. to avoid double spending).

And yet, the two take an inherently different approach towards that goal. PoW v.s. PoS: Buying a shovel v.s. Deposit in a bank.

By definition, Proof-of-Work means to solve the hash function and prove the result is correct. While it’s hard to unravel the function, it’s easy for other miners to verify the result once a miner gets it – just putting it back to the function to see if it works out, like an algebraic problem. If it does, congrats! Here’s the prize. So take out your shovel, do the physical work, and show everybody you have mined the gold.

Proof-of-Stake, however, is a mechanism that needs no math. Instead, inside the network, you simply lock up a certain amount of your stake, i.e. your whatever cryptocurrency generated in this blockchain. That is your proof because something is at stake.

The network uses a random selection algorithm to determine who the next block creator is, with factors like how many coins you lock up, what the coin’s age is, or how long you have locked up already, etc. Different PoS-based blockchain has various criteria, but the gist is not much hardware work is required. It’s somewhat like deposition and interests.

In PoW-based blockchain, miners do the hard work and will be rewarded. Recall Bitcoin and Ethereum, where a new block rewards 12.5 Bitcoins and 5 Ethers. But there’s another thing called a transaction fee. When you send a Bitcoin to me, that transaction needs to be validated and documented on the blockchain through the hash function math that miners are doing.

But they are not doing it for free so you need to attach a transaction fee. The next lucky miner who creates the next block will receive all the transaction fees and the block reward itself, so it’s 12.5+ Bitcoins.

In PoS method, the blockchain has no block reward. Only transaction fees. That’s also why participants in the PoS blockchain should be called validators, not miners. They only facilitate the validation process of transactions without the mining activity like PoW does.</p>

POOL OF STAKE ICO DETAILS

Category : Cryptocurrency, Infrastructure, Mining, Platforms & Ecosystems

Country : Switzerland

ICO date : 2018-05-02 / 2018-06-03

Ends In : 44 days

Website : https://www.poolofstake.io/

POOL OF STAKE ROADMAP

POOL OF STAKE TEAM

POOL OF STAKE RATING

- icorating.com (Risk):NOT RATED

- icobench.com:4.0 / 5

- icobazaar.com:TBAtrackico.io:4.3 / 5foxico.com:6.0 / 10

- icomarks.com:5.7 / 10

- icostock 24.com: 3.9 / 5

For more info on this project, please visit the link below:

ANN THREAD : https://bitcointalk.org/index.php?topic=3283742.0

TWITTER : https://twitter.com/poolofstake

WHITE PAPER : https://www.poolofstake.io/wp-content/uploads/2018/04/Pool_of_Stake_whitepaper.pdf

TELEGRAM : https://web.telegram.org/#/im?p=@poolofstake

FACEBOOK : https://www.facebook.com/poolofstake

Author:[ Cintia plug ]

My Bitcointalk Link Profile: https://bitcointalk.org/index.php?action=profile;u=1565176

Komentar

Posting Komentar