CEYRON

CEYRON - Token Paying Annual Dividends by Debit Card Worldwide

Financial industry progress and block chains are now in doubt. For Tokens is needed which can combine both. Ceyron Finance Ltd (hereinafter referred to as "CFL") intends to bring together financial industry expertise and revolutionary block chain technology. CFLs disrupt two different worlds: cryptomonnaie and financial services.

www.ceyron.io becomes a cryptocurrency based on investment platforms with cryptocurrency trading terminals, debit card and chip capabilities offering secure credit assets.

The proof of Ceyron is ...

The token is something that can be used instead of money. The CEY token is a token that will be given to investors (investors) and it represents profitable interests in a separate class from Ceyron's non-voting shares. CEY Token is an intelligent functional functional contract in Mutual Funds. Non-refundable CEY tokens This is not for speculative investment.

Ceyron Finance Sarl (CFS), is a limited liability company established under the Limited Liability Company Law ("Dana") and wholly owned by Ceyron Finance Ltd. CFLs and the IMF have signed an operating agreement to determine their rights. and the obligations of each party.

Sub-Funds will be managed and advised by Colombus Investment Management Ltd ("Investment Manager"). Colombus Investment Management Ltd, is one of the British Virgin Islands which is registered as an independent alternative investment management company specializing in alternative assets and global asset allocation. The Fund Manager will be responsible for the Investment Fund business and will carry out all services and activities related to the management of assets, liabilities and operations of the Fund.

Investment objectives and strategies

Net income earned by the Fund in a particular month is usually reinvested, but some periodic potential profits can be used to distribute annual dividends to CEY token holders, where the dividend is approved by the board of directors and shareholders of CFL shareholders.

Tokens are protected by a credit portfolio due to volatility and less cash flow

The loan asset portfolio will also be guaranteed by bonds to improve stability and yield. Fund managers will use artificial intelligence and machine learning to build a safe credit asset portfolio.

Blockchain technology provides effective liquidity for investors

Blockchain technology has the potential to provide greater integrity, security, security and transparency. As such, CFLs will use blockchain to ensure direct low-cost trade auctions in the hope of providing greater liquidity to investors.

Effective prepaid debit card

Account holders can choose some crypto that can be used as an offer, and when starting a transaction (for example, dinner at a cost of $ 83.65), prepaid debit will be used, or the Holder can choose a supported cryptocurrency, which will then be sold at spot prices for complete the transaction.

Competitive costs

Because the CFL will hold both cash and various crypto at any time, it will be able to facilitate the exchange of funds in crypto to facilitate transactions and allow CFLs to compete with Coinbase for services and fees.

The cryptocurrency market grew more than $ 160 billion ($ 160 billion) last year. Financial giants and central banks invest in blockchain technology. Large and small investors are looking for a more regular market that can benefit from the safety nets and insurance coverage offered in the registered security market.

The questions raised for developing countries

The population of developing countries (Southeast Asia, Latin America and Africa) represents more than 2 billion people. Africa alone accounts for 1.2 billion people. It's young and dynamic: 60% are under 50 years old.

The bank has gradually adopted mobile banking for:

1) developing online banking services;

2) provide digital benefits to the parties to integrate millions of people into the formal financial sector;

3) developing merchant payment services.

Low interest rate

According to experts, more than 2.5 billion low-income and / or middle-income people are not tied to banks. Traditional agency models easily meet the needs of the poorest but no longer meet the bank's overall requirements.

The reason for low banking penetration is at two levels .

1. At the client level: most people only have low or very low income, and therefore their savings capacity is low. While economic monetization has increased rapidly since the 2000s, bank use has not become part of spontaneous practice. The emergence and growth of very large microfinance companies radically changed this situation.

2. At the bank level: excess bank liquidity is not an incentive for customers to grow. Low population density adds average costs to implementing agencies.

Very competitive market

More than 75% of countries have most services where mobile money services are available. This increased competition means that consumers have more choices. Some subscribe to two or three services simultaneously.

Very low usage rate

Africa is a world leader in the field of mobile money accounts 2% of adults have mobile money accounts in the world, 12% of holders are in Africa. Every year, the number of open mobile mobile accounts has increased by more than 40% on average. By 2020, the number of Africans with discretionary income - nearly 450 million people - will be comparable to, if not higher than, Western Europe with an average growth rate of 20% per year. By 2020, there will be nearly 800 million people who have mobile money accounts. The result: nearly 10 billion transactions per day, worth nearly 135 billion dollars in 2020.

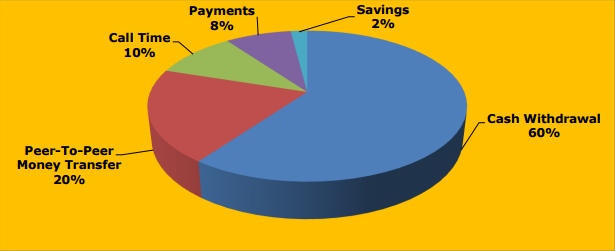

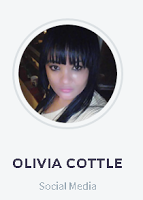

Analysis of the behavior of the average payment user seems to be a general trend: the withdrawal represents at least 60% of the transaction volume; peer-to-peer transfer operation 20%; purchase of 10% call time, 8% payment and 2% savings.

Shy pause through a bank card

CEY token holders will be privileged to receive their annual dividends on their CFL cards.

Lack of safe and unsecured credit for credit applicants

The CFL intends to solve problems in Africa where there is a lack of credit available to most applicants. In particular, dividends distributed to CEY token holders will allow them to qualify for credit because dividends can be considered as a source of income.

In Africa, there is a lack of stable and sustainable income in terms of credit applications.

CFL solution

CFL Credit PortfolioToday, sixty percent (60%) of US mortgages are owned by non-banks, up from thirty percent (30%) in 2013. More than four trillion US dollars in the US are available mortgages to select hundreds of bank credit platforms. The fund manager is responsible for approving the solvency and risks associated with the platform and identifying the credit profiles of the assets issued, regulatory compliance regarding the origin, volume, guarantee, duration and level, quality of management and services. The fund manager will be responsible for selecting the best performing assets available on this platform for the CFL portfolio, and also for cleaning up the most risky assets in the CFL portfolio.

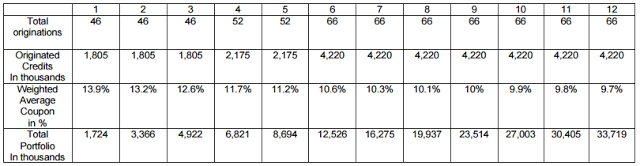

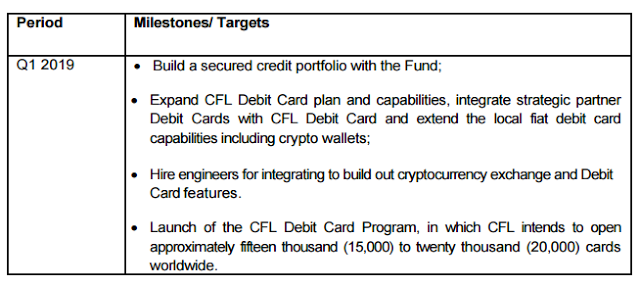

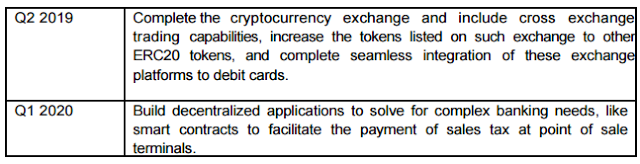

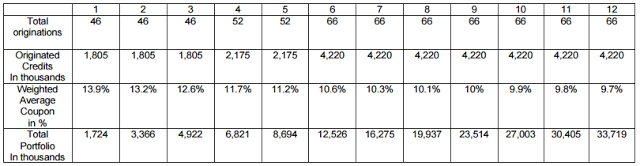

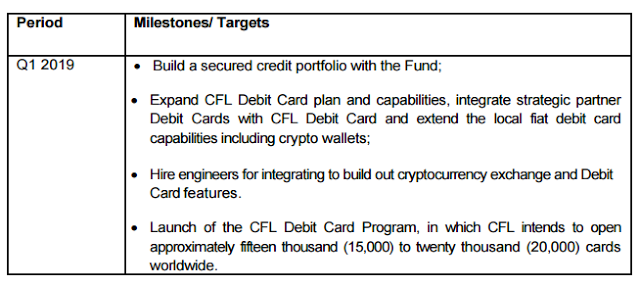

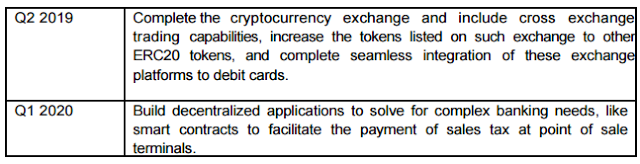

Investment Road Map

Carte CEY

The CEY card will become a physical, virtual and debit MasterCard with a mobile application that allows the use of twenty (20) foreign currencies from one card. CFLs can save up to seventy percent (70%) for this fee. Currency can be traded at both points of sale (industry average is 3.75% versus 3% for CFLs), and also through applications. In addition, unlike one and half percent (1.5%) fees for ATM withdrawals, CFLs do not charge fees for ABM withdrawals. The CFL mobile application will contain additional features to transfer funds in the currency between the merchant, friends and family accounts, so as to make money at zero percent (0%).

CFL cards plan to have partners for managing costs. This will allow integration of the mobile application to facilitate the management of travel trips and links to many travel partners for managing electronic receipts. In short, CFLs will be developed to provide increased liquidity in one of twenty (20) world currencies and major crypto currencies.

LCF and Blockchain

Cryptocurrency (or cryptocurrency) is a digital asset designed to function as a medium of exchange that uses cryptography to secure transactions, to control the creation of additional units and to verify the transfer of assets.

Cryptocurrency has been designed as a method for decentralized transactions with value held in rare digital assets. This is most striking in societies where the government loses their money with hyperinflation. Currently, fifty percent (50%) of people in the world have bank accounts. In 2014, it was 62%, and cryptocurrencies took up more space among people who were not opinionated. Cryptocurrency has been designed as a method for decentralized transactions with value held in rare digital assets. This is most striking in societies where the government loses their money with hyperinflation. Currently, fifty percent (50%) of people in the world have bank accounts.In 2014, it was 62%, and cryptocurrencies took up more space among people who were not opinionated.

The cryptocurrency currency market has only been operating for several years. A relatively large difference between the price of fiat Bitcoin in different main markets illustrates the current level of industrial maturity.

Blockchain technology is still young, but has proven itself as a registry that cannot be changed. Bitcoin is a speculative sign, and its value, such as diamonds or gold, outside industrial use, is fully motivated by scarcity and guarantee for holders that this property is unique and ready to be traded.

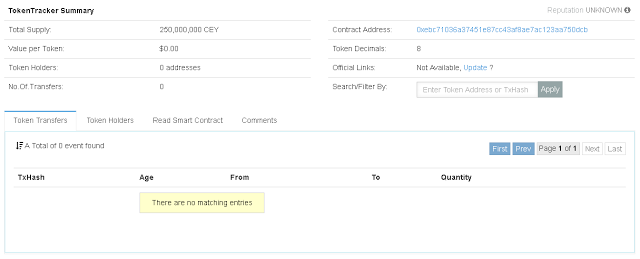

CFL Security Token

The CFL intends to provide, but does not guarantee, token holders with annual dividends, which must be approved by the Board of Directors and voting shareholders.

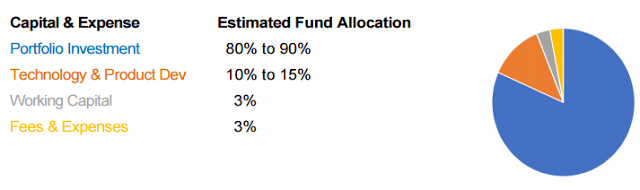

The CFL intends to invest eighty-five percent (85%) of the funds received by the CFL at the IMF, and the IMF will in turn invest in credit assets, trying to create a stable cash flow. and grow. CEY Tokens (cash flow returns cannot be guaranteed and may be affected by market conditions and regulations)

The CFL intends to use simple leverage to further improve the results of the credit portfolio to facilitate continuous reinvestment and improvement of the Cey chip's underlying credit portfolio (improvement results can be guaranteed and may not be affected by market conditions and regulations)

The CFL will increase its ability to build a leveraged loan portfolio by providing warehouse lenders with credit guarantees.

CFLs intend to hold cash, securities and symbolic reserves at all times to ensure the liquidity of CEY token holders (asset liquidity cannot be guaranteed and may be affected by market conditions and regulations).

CFLs will enter into alliances with bonding service providers that will be used to reduce the risk of total capital loss. However, the use of this financial instrument is not a guarantee of any possibility.

Strategic Alliance

The CFL strategic alliance is an established leader in blockchain technology, finance and banking. CFL intends to sign a service agreement with Coinfirm.io regarding KYC / AML (Anti Money Laundering) control for each token holder application. Ambisafe is a pioneer of blockchain technology and ICO offers companies that help the world become more decentralized since 2010. Their work is very important in projects like Tether and Bitfinex. Recently, Ambisafe is behind this success. Loyal Bank is a registered bank under the laws of Saint Vincent and the Grenadines.

Market plan

Initial CFL coin offer

CEY Token bids in Saint Vincent and the Grenadines are carried out based on the exemptions granted by the Securities Act. The CEY quota offered here (and the non-voting shares of CFL Ltd. held by the candidate) may not be sold to other bidders in Saint Vincent and the Grenadines unless the FSA provisions are respected.

The CFL will provide an offer memorandum that will be prepared solely for use by prospective CFL investors, which will be issued by the CFL. The Bid Memorandum will be prepared as part of a private offer to accredited investors, to people who will be asked to verify their accredited investor status through questionnaires and other required documents, and others who respond to the participation requirements in their jurisdiction.

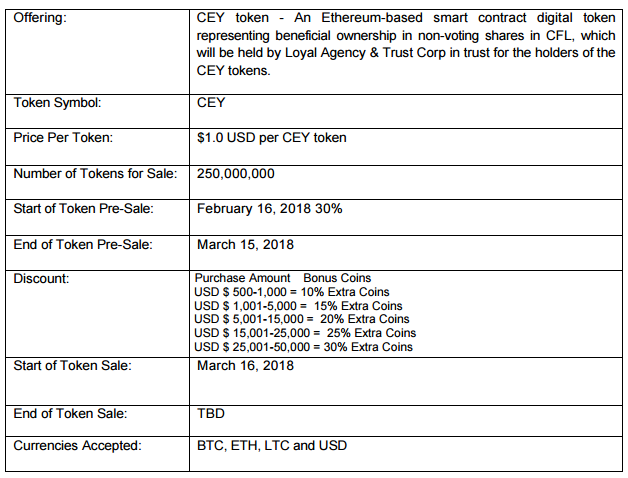

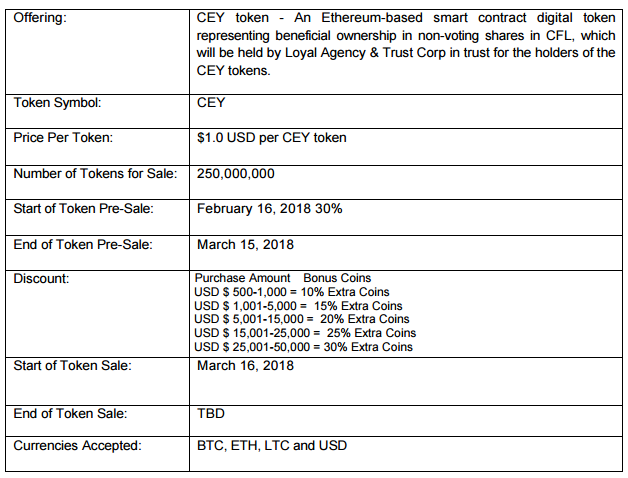

Summary of offers

Technical Bid Mechanism

Potential investors will be asked to provide personal identification information when creating an account at ceyron.io to participate in sales. This information is intended to ensure compliance with various securities laws in the United States and foreign jurisdictions, as well as customer knowledge requirements (KYC) and money laundering (AML) wars.

For US investors, they must meet the standard "Qualified Investor" requirements under Section 506 (c) of the D Securities Act. An investor can indicate that he qualifies as an investor who meets the requirements by documenting and downloading documents on the ceyron.io website, as described in the following section entitled "Investment Participation".

Participation in the offer

Offerings to prospective investors in the United States are limited to accredited investors in the meaning of Regulation D of the Securities Act, ie only persons or entities that are included in one or more of the following categories:

Bank, as defined in paragraph 3 (a) (2) of the Securities Act, or savings and credit association or other institution defined in section 3 (a) (5) (A) of the individual Securities Act or fiduciary; dealers registered under section 15 of the Exchange Act; insurance company as referred to in Article 2 (13) of the Securities Act; every investment company registered under the Act of 1940 Investment Company or business development company referred to in part 2 (a) (48) of the Act; every small business investment company approved by the US Small Business Administration based on section 301 (c) or (d) of the Small Business Investment Act of 1958; plans that are created and maintained by a State, its political subdivisions or bodies or instruments of a State or part of its constitution for the benefit of its employees, if the plan has a total asset of more than US $ 5 million (5,000,000,000) $); and any benefit plan in the sense of the Employee Retirement Income Act, 1974, if the investment decision is made by the trustee in accordance with article 3 (21) of the Act, the bank,

Every private company development company referred to in section 202 (a) (22) of the Investment Advisory Act of 1940;

Each organization described in section 501 (c) (3) of the Internal Revenue Code of 1986, as amended, the company, Massachusetts or similar trust, or a company not established for the specific purpose of obtaining such ordinary shares, with total assets exceeding USD 5 million (USD 5,000,000);

Every director or company official;

Every individual who has a net worth or net worth together with that person, does not include the value of their primary residence after deducting the mortgage debt and other rights, when the purchase exceeds one million USD (1,000,000 $);

Every individual whose personal income exceeds two hundred thousand US dollars ($ 200,000), or combined income with a partner of more than three hundred thousand dollars ($ 300,000), for each of the last two years and which is sufficient to expect to achieve the same level of income for the year walk;

Any trust whose total assets are greater than US $ 5 million ($ 5,000,000) and which are not established for the specific purpose of acquiring ordinary shares purchased by sophisticated persons described in Rule 506 (b) (2) (ii) of the Regulations D; or

Every entity whose shareholders are all investors who meet the requirements

To invest in this offer, investors must first create an account and register at www.ceyron.io. In accordance with article 506 (c) of the Securities Act, proof of mandatory accreditation status is invested. This can be fulfilled during the account creation process by completing the accreditation process in one of three ways:

Accreditation is based on investor income

Accreditation is based on investors' net assets

Third Party Verification Letter

Post requirements and transfer restrictions

The CEY sign is offered and issued to people other than Americans based on the Regulation of the Securities Act. Each CEY token customer will be considered to represent, guarantee and accept the following:

Whether it's: Qualified Investor (as defined in Regulation 501 of Regulation D based on the Securities Act); or not "US" and obtain CEY tokens in "offshore transactions"

If a customer is a buyer in a transaction in the United States,

The CEY token will not be sold to anyone with another offer in Saint Vincent and the Grenadines unless the FSA provisions are followed.

The Customer acknowledges that the CFL will not be asked to accept the registration for the transfer of the CEY Token obtained by the CFL, except when providing satisfactory evidence to the CFL that the restrictions set forth here have been complied with.

Reporting and transparency for investors

Statement of Net Asset Value of Mutual Funds

The CFL intends to issue the net asset value of the Fund on a monthly and quarterly basis on its site.

Methodology for calculating net asset value

NAV = (accumulated accumulated interest - accumulated net loss) / (principal amount of loan + total cash)

The net asset value per CEY token will be calculated by dividing the net asset value by the number of CEY tokens circulating on the date the calculation is rounded to the nearest cent. The number of outstanding CEY tokens is calculated as the number of CEY Tokens issued and circulated, minus the redemption made by the CFL.

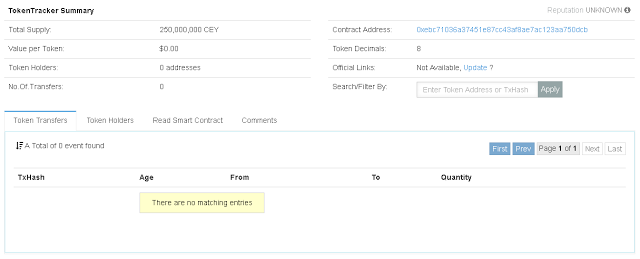

Token from Ceyron

Product use

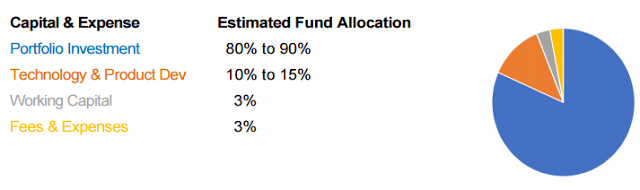

CEY token funds will be used to finance:

General business riskIn the event of an economic downturn, the company's business plan, the ability to generate revenue and overall solvency can be risky. Companies in the start up stage are generally very risky and the possibility of a company failure whatever the business climate in general is possible.

Specific business risk

Investments in natural vehicles involve a variety of inherent risks, which can result in: (i) loss of overall investor capital, (ii) investment returns below the target, or (iii) lower than estimated liquidity, among others.

Credit risk

There is no guarantee that the IMF's investment objectives will be achieved and investors will not experience losses. To reduce the risk of significant credit losses, CFLs will take appropriate credit loss provisions, which will be accumulated on each asset in accordance with our credit guidelines, which are typical financial institutions that invest in similar credit assets. .

Portfolio risk

There is a risk that CFLs will not achieve the desired results. Coupons and yields for maturity of the CFL portfolio are very important for our ability to generate consistent dividends for shareholders and to continue to reinvest our portfolio, thereby increasing the lasting value of portfolios and tokens.

CFLs may not be able to achieve the desired level of debt in a portfolio with the desired debt costs. As a result, there is a risk that the investor's net portfolio returns will not be achieved. As far as CFLs intend to use senior financial leverage, the risk to investors can be increased by the guarantee of seniority senior guarantees of assets in the portfolio.

Liquidity risk token

CEY tokens may not reach the desired level of liquidity, which will result in less than expected liquidity for investors.

Regulatory risk

The failure of the CFL to obtain prior regulatory approval in the jurisdiction where the company operates or the regulator's refusal to grant such authorization in jurisdictions that can operate can prevent CFLs from maintaining or expanding their activities. In addition, changes in laws or regulations, including the application of new licensing, advertising, Internet or e-commerce rules (or changes to the application or interpretation of existing laws or regulations). Jurisdictions where the CFL is currently operating may require a CFL to cease operations or change the way it operates in that jurisdiction. These changes can also have a negative impact on operations, financial conditions,

Data privacy and security

All data provided to us is stored in a secure computing environment that is protected by a secure firewall to prevent unauthorized access. The company controls access so that only those who need access to the data of investors who have access to it. All CFL team members undergo security training and are asked to comply with a set of security policies, procedures and standards related to their duties.

CFL Management Team

advisor

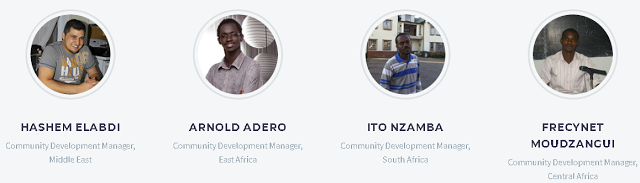

Direction

Financial industry progress and block chains are now in doubt. For Tokens is needed which can combine both. Ceyron Finance Ltd (hereinafter referred to as "CFL") intends to bring together financial industry expertise and revolutionary block chain technology. CFLs disrupt two different worlds: cryptomonnaie and financial services.

www.ceyron.io becomes a cryptocurrency based on investment platforms with cryptocurrency trading terminals, debit card and chip capabilities offering secure credit assets.

The proof of Ceyron is ...

The token is something that can be used instead of money. The CEY token is a token that will be given to investors (investors) and it represents profitable interests in a separate class from Ceyron's non-voting shares. CEY Token is an intelligent functional functional contract in Mutual Funds. Non-refundable CEY tokens This is not for speculative investment.

Ceyron Finance Sarl (CFS), is a limited liability company established under the Limited Liability Company Law ("Dana") and wholly owned by Ceyron Finance Ltd. CFLs and the IMF have signed an operating agreement to determine their rights. and the obligations of each party.

Sub-Funds will be managed and advised by Colombus Investment Management Ltd ("Investment Manager"). Colombus Investment Management Ltd, is one of the British Virgin Islands which is registered as an independent alternative investment management company specializing in alternative assets and global asset allocation. The Fund Manager will be responsible for the Investment Fund business and will carry out all services and activities related to the management of assets, liabilities and operations of the Fund.

Investment objectives and strategies

The investment objective of the IMF is to provide attractive returns on the capital invested through an exclusive quantitative approach to underwriting credit assets, which was given by Colombus Investment Management Ltd. The funds will follow an investment strategy based on scientific data. The nonparametric statistical model is applied to the problem of expected profits in financial investment.

Net income earned by the Fund in a particular month is usually reinvested, but some periodic potential profits can be used to distribute annual dividends to CEY token holders, where the dividend is approved by the board of directors and shareholders of CFL shareholders.

Tokens are protected by a credit portfolio due to volatility and less cash flow

The loan asset portfolio will also be guaranteed by bonds to improve stability and yield. Fund managers will use artificial intelligence and machine learning to build a safe credit asset portfolio.

Blockchain technology provides effective liquidity for investors

Blockchain technology has the potential to provide greater integrity, security, security and transparency. As such, CFLs will use blockchain to ensure direct low-cost trade auctions in the hope of providing greater liquidity to investors.

Effective prepaid debit card

Account holders can choose some crypto that can be used as an offer, and when starting a transaction (for example, dinner at a cost of $ 83.65), prepaid debit will be used, or the Holder can choose a supported cryptocurrency, which will then be sold at spot prices for complete the transaction.

Competitive costs

Because the CFL will hold both cash and various crypto at any time, it will be able to facilitate the exchange of funds in crypto to facilitate transactions and allow CFLs to compete with Coinbase for services and fees.

CFLs enter developing markets

The cryptocurrency market grew more than $ 160 billion ($ 160 billion) last year. Financial giants and central banks invest in blockchain technology. Large and small investors are looking for a more regular market that can benefit from the safety nets and insurance coverage offered in the registered security market.

The questions raised for developing countries

The population of developing countries (Southeast Asia, Latin America and Africa) represents more than 2 billion people. Africa alone accounts for 1.2 billion people. It's young and dynamic: 60% are under 50 years old.

The bank has gradually adopted mobile banking for:

1) developing online banking services;

2) provide digital benefits to the parties to integrate millions of people into the formal financial sector;

3) developing merchant payment services.

Low interest rate

According to experts, more than 2.5 billion low-income and / or middle-income people are not tied to banks. Traditional agency models easily meet the needs of the poorest but no longer meet the bank's overall requirements.

The reason for low banking penetration is at two levels .

1. At the client level: most people only have low or very low income, and therefore their savings capacity is low. While economic monetization has increased rapidly since the 2000s, bank use has not become part of spontaneous practice. The emergence and growth of very large microfinance companies radically changed this situation.

2. At the bank level: excess bank liquidity is not an incentive for customers to grow. Low population density adds average costs to implementing agencies.

Very competitive market

More than 75% of countries have most services where mobile money services are available. This increased competition means that consumers have more choices. Some subscribe to two or three services simultaneously.

Very low usage rate

Africa is a world leader in the field of mobile money accounts 2% of adults have mobile money accounts in the world, 12% of holders are in Africa. Every year, the number of open mobile mobile accounts has increased by more than 40% on average. By 2020, the number of Africans with discretionary income - nearly 450 million people - will be comparable to, if not higher than, Western Europe with an average growth rate of 20% per year. By 2020, there will be nearly 800 million people who have mobile money accounts. The result: nearly 10 billion transactions per day, worth nearly 135 billion dollars in 2020.

Analysis of the behavior of the average payment user seems to be a general trend: the withdrawal represents at least 60% of the transaction volume; peer-to-peer transfer operation 20%; purchase of 10% call time, 8% payment and 2% savings.

Shy pause through a bank card

CEY token holders will be privileged to receive their annual dividends on their CFL cards.

Lack of safe and unsecured credit for credit applicants

The CFL intends to solve problems in Africa where there is a lack of credit available to most applicants. In particular, dividends distributed to CEY token holders will allow them to qualify for credit because dividends can be considered as a source of income.

In Africa, there is a lack of stable and sustainable income in terms of credit applications.

CFL solution

CFL Credit PortfolioToday, sixty percent (60%) of US mortgages are owned by non-banks, up from thirty percent (30%) in 2013. More than four trillion US dollars in the US are available mortgages to select hundreds of bank credit platforms. The fund manager is responsible for approving the solvency and risks associated with the platform and identifying the credit profiles of the assets issued, regulatory compliance regarding the origin, volume, guarantee, duration and level, quality of management and services. The fund manager will be responsible for selecting the best performing assets available on this platform for the CFL portfolio, and also for cleaning up the most risky assets in the CFL portfolio.

Investment Road Map

Carte CEY

The CEY card will become a physical, virtual and debit MasterCard with a mobile application that allows the use of twenty (20) foreign currencies from one card. CFLs can save up to seventy percent (70%) for this fee. Currency can be traded at both points of sale (industry average is 3.75% versus 3% for CFLs), and also through applications. In addition, unlike one and half percent (1.5%) fees for ATM withdrawals, CFLs do not charge fees for ABM withdrawals. The CFL mobile application will contain additional features to transfer funds in the currency between the merchant, friends and family accounts, so as to make money at zero percent (0%).

CFL cards plan to have partners for managing costs. This will allow integration of the mobile application to facilitate the management of travel trips and links to many travel partners for managing electronic receipts. In short, CFLs will be developed to provide increased liquidity in one of twenty (20) world currencies and major crypto currencies.

LCF and Blockchain

Cryptocurrency (or cryptocurrency) is a digital asset designed to function as a medium of exchange that uses cryptography to secure transactions, to control the creation of additional units and to verify the transfer of assets.

Cryptocurrency has been designed as a method for decentralized transactions with value held in rare digital assets. This is most striking in societies where the government loses their money with hyperinflation. Currently, fifty percent (50%) of people in the world have bank accounts. In 2014, it was 62%, and cryptocurrencies took up more space among people who were not opinionated. Cryptocurrency has been designed as a method for decentralized transactions with value held in rare digital assets. This is most striking in societies where the government loses their money with hyperinflation. Currently, fifty percent (50%) of people in the world have bank accounts.In 2014, it was 62%, and cryptocurrencies took up more space among people who were not opinionated.

The cryptocurrency currency market has only been operating for several years. A relatively large difference between the price of fiat Bitcoin in different main markets illustrates the current level of industrial maturity.

Blockchain technology is still young, but has proven itself as a registry that cannot be changed. Bitcoin is a speculative sign, and its value, such as diamonds or gold, outside industrial use, is fully motivated by scarcity and guarantee for holders that this property is unique and ready to be traded.

CFL Security Token

The CFL intends to provide, but does not guarantee, token holders with annual dividends, which must be approved by the Board of Directors and voting shareholders.

The CFL intends to invest eighty-five percent (85%) of the funds received by the CFL at the IMF, and the IMF will in turn invest in credit assets, trying to create a stable cash flow. and grow. CEY Tokens (cash flow returns cannot be guaranteed and may be affected by market conditions and regulations)

The CFL intends to use simple leverage to further improve the results of the credit portfolio to facilitate continuous reinvestment and improvement of the Cey chip's underlying credit portfolio (improvement results can be guaranteed and may not be affected by market conditions and regulations)

The CFL will increase its ability to build a leveraged loan portfolio by providing warehouse lenders with credit guarantees.

CFLs intend to hold cash, securities and symbolic reserves at all times to ensure the liquidity of CEY token holders (asset liquidity cannot be guaranteed and may be affected by market conditions and regulations).

CFLs will enter into alliances with bonding service providers that will be used to reduce the risk of total capital loss. However, the use of this financial instrument is not a guarantee of any possibility.

Strategic Alliance

The CFL strategic alliance is an established leader in blockchain technology, finance and banking. CFL intends to sign a service agreement with Coinfirm.io regarding KYC / AML (Anti Money Laundering) control for each token holder application. Ambisafe is a pioneer of blockchain technology and ICO offers companies that help the world become more decentralized since 2010. Their work is very important in projects like Tether and Bitfinex. Recently, Ambisafe is behind this success. Loyal Bank is a registered bank under the laws of Saint Vincent and the Grenadines.

Market plan

Initial CFL coin offer

CEY Token bids in Saint Vincent and the Grenadines are carried out based on the exemptions granted by the Securities Act. The CEY quota offered here (and the non-voting shares of CFL Ltd. held by the candidate) may not be sold to other bidders in Saint Vincent and the Grenadines unless the FSA provisions are respected.

The CFL will provide an offer memorandum that will be prepared solely for use by prospective CFL investors, which will be issued by the CFL. The Bid Memorandum will be prepared as part of a private offer to accredited investors, to people who will be asked to verify their accredited investor status through questionnaires and other required documents, and others who respond to the participation requirements in their jurisdiction.

Summary of offers

Technical Bid Mechanism

Potential investors will be asked to provide personal identification information when creating an account at ceyron.io to participate in sales. This information is intended to ensure compliance with various securities laws in the United States and foreign jurisdictions, as well as customer knowledge requirements (KYC) and money laundering (AML) wars.

For US investors, they must meet the standard "Qualified Investor" requirements under Section 506 (c) of the D Securities Act. An investor can indicate that he qualifies as an investor who meets the requirements by documenting and downloading documents on the ceyron.io website, as described in the following section entitled "Investment Participation".

Participation in the offer

Offerings to prospective investors in the United States are limited to accredited investors in the meaning of Regulation D of the Securities Act, ie only persons or entities that are included in one or more of the following categories:

Bank, as defined in paragraph 3 (a) (2) of the Securities Act, or savings and credit association or other institution defined in section 3 (a) (5) (A) of the individual Securities Act or fiduciary; dealers registered under section 15 of the Exchange Act; insurance company as referred to in Article 2 (13) of the Securities Act; every investment company registered under the Act of 1940 Investment Company or business development company referred to in part 2 (a) (48) of the Act; every small business investment company approved by the US Small Business Administration based on section 301 (c) or (d) of the Small Business Investment Act of 1958; plans that are created and maintained by a State, its political subdivisions or bodies or instruments of a State or part of its constitution for the benefit of its employees, if the plan has a total asset of more than US $ 5 million (5,000,000,000) $); and any benefit plan in the sense of the Employee Retirement Income Act, 1974, if the investment decision is made by the trustee in accordance with article 3 (21) of the Act, the bank,

savings and loan, association, insurance company or registered investment advisor, if the total asset of the benefit plan exceeds five million US dollars ($ 5,000,000) or, in the case of a self-regulated plan;

Every private company development company referred to in section 202 (a) (22) of the Investment Advisory Act of 1940;

Each organization described in section 501 (c) (3) of the Internal Revenue Code of 1986, as amended, the company, Massachusetts or similar trust, or a company not established for the specific purpose of obtaining such ordinary shares, with total assets exceeding USD 5 million (USD 5,000,000);

Every director or company official;

Every individual who has a net worth or net worth together with that person, does not include the value of their primary residence after deducting the mortgage debt and other rights, when the purchase exceeds one million USD (1,000,000 $);

Every individual whose personal income exceeds two hundred thousand US dollars ($ 200,000), or combined income with a partner of more than three hundred thousand dollars ($ 300,000), for each of the last two years and which is sufficient to expect to achieve the same level of income for the year walk;

Any trust whose total assets are greater than US $ 5 million ($ 5,000,000) and which are not established for the specific purpose of acquiring ordinary shares purchased by sophisticated persons described in Rule 506 (b) (2) (ii) of the Regulations D; or

Every entity whose shareholders are all investors who meet the requirements

To invest in this offer, investors must first create an account and register at www.ceyron.io. In accordance with article 506 (c) of the Securities Act, proof of mandatory accreditation status is invested. This can be fulfilled during the account creation process by completing the accreditation process in one of three ways:

Accreditation is based on investor income

Accreditation is based on investors' net assets

Third Party Verification Letter

Post requirements and transfer restrictions

The CEY sign is offered and issued to people other than Americans based on the Regulation of the Securities Act. Each CEY token customer will be considered to represent, guarantee and accept the following:

Whether it's: Qualified Investor (as defined in Regulation 501 of Regulation D based on the Securities Act); or not "US" and obtain CEY tokens in "offshore transactions"

If a customer is a buyer in a transaction in the United States,

you know that until the end of the lock-up period, you will not be allowed to offer, sell or transfer CEY tokens and after that date, you are no longer authorized to sell or transfer CEY tokens to other people in the United States unless they sell all of their CEY tokens to one person in the United States.

If the Customer is a buyer transacting outside the United States with the intention of the S Rules, you acknowledge that you may not sell or transfer the CEY Token at any time to the US Party or to the account or benefit of the US Person in the meaning of Regulation 902 under the Securities Act. However, non-Americans can sell CEY tokens to other foreign investors in connection with foreign operations in accordance with Rule 903 and 904 of the Securities Act and can comply with applicable laws. other regions

If the Customer is a buyer transacting outside the United States with the intention of the S Rules, you acknowledge that you may not sell or transfer the CEY Token at any time to the US Party or to the account or benefit of the US Person in the meaning of Regulation 902 under the Securities Act. However, non-Americans can sell CEY tokens to other foreign investors in connection with foreign operations in accordance with Rule 903 and 904 of the Securities Act and can comply with applicable laws. other regions

The CEY token will not be sold to anyone with another offer in Saint Vincent and the Grenadines unless the FSA provisions are followed.

The Customer acknowledges that the CFL will not be asked to accept the registration for the transfer of the CEY Token obtained by the CFL, except when providing satisfactory evidence to the CFL that the restrictions set forth here have been complied with.

Reporting and transparency for investors

Statement of Net Asset Value of Mutual Funds

The CFL intends to issue the net asset value of the Fund on a monthly and quarterly basis on its site.

Methodology for calculating net asset value

NAV = (accumulated accumulated interest - accumulated net loss) / (principal amount of loan + total cash)

The net asset value per CEY token will be calculated by dividing the net asset value by the number of CEY tokens circulating on the date the calculation is rounded to the nearest cent. The number of outstanding CEY tokens is calculated as the number of CEY Tokens issued and circulated, minus the redemption made by the CFL.

Token from Ceyron

Product use

CEY token funds will be used to finance:

RISK FACTORS

General business riskIn the event of an economic downturn, the company's business plan, the ability to generate revenue and overall solvency can be risky. Companies in the start up stage are generally very risky and the possibility of a company failure whatever the business climate in general is possible.

Specific business risk

Investments in natural vehicles involve a variety of inherent risks, which can result in: (i) loss of overall investor capital, (ii) investment returns below the target, or (iii) lower than estimated liquidity, among others.

Credit risk

There is no guarantee that the IMF's investment objectives will be achieved and investors will not experience losses. To reduce the risk of significant credit losses, CFLs will take appropriate credit loss provisions, which will be accumulated on each asset in accordance with our credit guidelines, which are typical financial institutions that invest in similar credit assets. .

Portfolio risk

There is a risk that CFLs will not achieve the desired results. Coupons and yields for maturity of the CFL portfolio are very important for our ability to generate consistent dividends for shareholders and to continue to reinvest our portfolio, thereby increasing the lasting value of portfolios and tokens.

CFLs may not be able to achieve the desired level of debt in a portfolio with the desired debt costs. As a result, there is a risk that the investor's net portfolio returns will not be achieved. As far as CFLs intend to use senior financial leverage, the risk to investors can be increased by the guarantee of seniority senior guarantees of assets in the portfolio.

Liquidity risk token

CEY tokens may not reach the desired level of liquidity, which will result in less than expected liquidity for investors.

Regulatory risk

The failure of the CFL to obtain prior regulatory approval in the jurisdiction where the company operates or the regulator's refusal to grant such authorization in jurisdictions that can operate can prevent CFLs from maintaining or expanding their activities. In addition, changes in laws or regulations, including the application of new licensing, advertising, Internet or e-commerce rules (or changes to the application or interpretation of existing laws or regulations). Jurisdictions where the CFL is currently operating may require a CFL to cease operations or change the way it operates in that jurisdiction. These changes can also have a negative impact on operations, financial conditions,

Data privacy and security

All data provided to us is stored in a secure computing environment that is protected by a secure firewall to prevent unauthorized access. The company controls access so that only those who need access to the data of investors who have access to it. All CFL team members undergo security training and are asked to comply with a set of security policies, procedures and standards related to their duties.

CFL Management Team

advisor

Direction

For more info on this project, please visit the link below:

Website : https://ceyron.io/

Telegram : https://t.me/joinchat/HlFUXhLIUYQL88_NtoM4sA

Twitter : https://twitter.com/search?q=ceyronico

Instagram : https://www.instagram.com/ceyronico/

Facebook : https://www.facebook.com/Ceyron/

Whitepaper : https://ceyron.io/wp-content/uploads/2018/02/White-Paper-ICO-CEY-Token-UPDATED31012018.pdf

Author:[ Cintia plug ]

My Bitcointalk Link Profile: https://bitcointalk.org/index.php?action=profile;u=1565176

Komentar

Posting Komentar